In this post:

- HubSpot partners making bold claims about HubSpot versus Salesforce

- Business sophistication (not size) is the key

- Salesforce clarity

- HubSpot’s direction

- A reasonable response

- Footnotes (including HubSpot gaps)

Bold claims

I’ve been a little puzzled by some of the posts I’ve seen on LinkedIn, over the last year or so, by HubSpot Partners making comparisons between HubSpot and Salesforce, often declaring HubSpot the ‘obvious’ winner…

You can read through examples of these types of posts via LinkedIn searches here and here.

Whilst some of the posts are quite measured (usually clearly identifying the audience they relate to eg startups or SMBs), others are generic and misleading.

Some of them even breathlessly make pronouncements on how ‘Salesforce is toast, HubSpot is coming for their lunch’ and other nonsense. Usually accompanied by fire or muscle emojis.

These pronouncements tend to come after a HubSpot announcement eg

- Clearbit acquisition

- Prospecting tool release

- Ops Hub update

- Custom objects improvement

- LendLease press release etc.

The posts are a little strange and they make me wonder whether the writers have actually had experience with a large Salesforce project. Or is their experience limited to just a small, contained mid-market or SMB scenario… I’m assuming the latter.

BTW as a little thought experiment, consider how odd it would be if a HubSpot competitor (e.g. ActiveCampaign) released a feature and their partners claimed HubSpot was now toast as a result… (more on this in the footnotes at the end).

Which means it’s important to clarify just what scenario we’re talking about.

Business sophistication (not size) is the key

If there’s only one thing you take from this post, please let it be this: focus on the sophistication of your customers (or prospects). (See the footnote at the end for how we gauge sophistication.)

Some context: There are plenty of sophisticated small business clients who are on a HubSpot Enterprise subscription, and there are plenty of Enterprise clients who just use HubSpot Pro.

Why? Because that’s what they need.

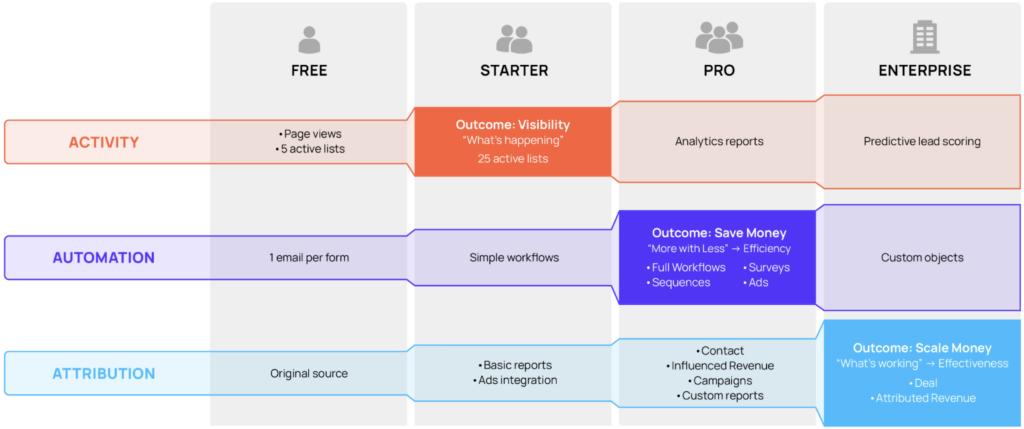

If you’ve ever been in one of the Masterclasses Ian and I run, you’ll have seen this image:

We refer to it as the outcome journey.

Essentially, we’re highlighting when a business should upgrade their HubSpot subscription from Starter to Pro to Enterprise.

Unfortunately, HubSpot’s tier naming is confusing – and you could be forgiven for thinking the ‘Enterprise’ tier is only for Enterprise size customers. But that’s not the case. We’ll happily move a small business to HubSpot Enterprise tier when appropriate (eg they need custom objects, or focus on attribution etc).

Likewise we’ll happily advise an Enterprise (size) corporate to stay on HubSpot Pro tier if that’s all they need.

Why mention all this?

Because it’s important to note that: the size of the company doesn’t dictate fit. Sophistication does.

HubSpot versus Salesforce clarity

Let’s return to our HubSpot versus Salesforce discussion.

What does this mean for those conversations?

It means we need to understand the client’s needs and advise appropriately:

- Is HubSpot the best fit for them – and if so, which tier

- If HubSpot isn’t the right fit, how do we best advise them to look elsewhere

When it comes to comparing Salesforce and HubSpot, it may turn out that HubSpot doesn’t actually have the sophistication the business requires.

In particular, the complexity of the scenario. Many startups and SMBs have simple CRM needs. Sometimes even enterprises have simple needs. No problem, HubSpot is a great fit for these.

But once the scenario gets complex, we need to be very careful about assuming HubSpot is a good fit. Sometimes (often?) it isn’t.

[See the end of this article where I’ve included a footnote section with some common examples of where HubSpot falls short.]HubSpot’s ideal fit is in common SMB and mid-market scenarios. Primarily general CRM and marketing scenarios.

They likely aren’t going to be business wide platform scenarios in enterprise (no matter how much HubSpot tests their platform messaging).

In the large enterprise space, we need to understand the scope.

Salesforce in the Enterprise space

If you were to simply look at the breakdown of Salesforce’ customer base, you could be misled by the number of SMB and mid-market companies that are customers – since only 11% are enterprise. You might think that Salesforce is focussed on mid-market. But that misses the fact that more than 90% of companies globally are small businesses. So of course the breakdown of their customers will be skewed to SMB.

The more interesting question would be how much revenue does Salesforce make from SMB versus enterprise (something I wasn’t able to find).

It’s likely that the majority of Salesforce revenue is from large enterprise customers. Keep in mind that one enterprise (defined as having more than >1000 employees) could easily include the equivalent 100+ small businesses (defined as having 1-10 employees).

For the large, sophisticated enterprise customers, projects are years long and enterprise wide.

For instance, consider how Telstra (in Australia) migrated from their previous system to Salesforce to manage their end-to-end operations, including retail and online. This massive, multi-year project isn’t something HubSpot would be a fit for.

Likewise, banks are highly unlikely to replace Salesforce with HubSpot. At most, HubSpot might find use in specific siloed marketing applications, but not at an enterprise wide scale.

Whilst I don’t doubt HubSpot has interest in that arena, it will be a long time before it’s a clear fit.

Where is HubSpot aiming?

Which leads to a broader question: What is HubSpot’s actual direction?

If their goal is to displace Salesforce in the enterprise market, they are, at best, a decade away from that goal, assuming Salesforce doesn’t advance further. But I don’t really think that’s where HubSpot is aiming.

HubSpot is more likely focusing on mid-market scenarios where Salesforce might be overly complex, aligning with their messaging for ‘growing businesses.’ However, this is vague.

The crucial question remains: What is HubSpot’s trajectory? In practical terms, large-scale implementations, like those involving comprehensive billing systems and identity management, are realms where Salesforce excels. HubSpot, despite its strengths, is not a good fit for such environments.

Some might point to welcome examples like the LendLease project, using it to argue HubSpot’s enterprise capability. But these are exceptions, and we don’t yet know how successful they will turn out to be (let’s review in a few years’ time). And yes, having custom objects in HubSpot has been a big unlock in some scenarios – but they don’t magically accommodate complex enterprise-wide business processes.

When I see the posts on this debate on LinkedIn, they often reveal a lack of understanding among partners and a need for clearer guidance from HubSpot.

Which brings me to my overall point for this section: If I’m unclear on HubSpot’s north star, then I assume most of our customers are as well.

I’m sure internally HubSpot is clear on their direction. But externally, it’s confusing.

I’d love to see clear guidance from HubSpot on what their 3+ year plans are, the scenarios and complexity they are targeting, and the messaging we partners can best use with our long term prospects and customers.

Is HubSpot WITH Salesforce the better discussion?

Ultimately though, perhaps the HubSpot versus Salesforce conversation has focussed on the wrong thing.

Maybe it’s not about choosing one over the other, perhaps the better conversation is around which parts of a company’s processes should be in each.

There’s a reason the Salesforce connector in HubSpot is well maintained… Salesforce and HubSpot working together is much more the norm than HubSpot replacing Salesforce in mid-market and above.

Summary

Pulling this all together.

The next time you see a post that attempts to compare HubSpot with Salesforce and starts discussing the pricing tiers of each, or granular feature set comparisons, be wary.

Instead, try to understand the business sophistication of your prospect (or customer) and advise within those parameters.

Does the business sophistication fit with HubSpot?

- Yes, good. Next, advise on which tier (Starter, Pro, Enterprise)

- No, also good. Next, point them to Salesforce or other tools, or perhaps the combination of HubSpot and Salesforce if appropriate.

Whatever you do, please don’t trot out, or point to, a generic response about HubSpot superiority.

Do you agree?

Footnotes

Footnote 1: If the bold claims were made by another platform

To get a sense of why the ‘HubSpot is better than Salesforce’ pronouncements are odd, consider this:

- Imagine you’re a HubSpot Partner and you see a post by an ActiveCampaign partner (or MailChimp or Campaign Monitor or other competitor) about a new feature their platform has just rolled out

- And they post about how HubSpot is toast and ActiveCampaign (or their platform) is eating HubSpot’s lunch etc

- You wouldn’t really take them seriously.

Sure, there’s scenarios where all of those tools are stealing away HubSpot customers at the lower end, but no-one seriously considers them a player in the mid-market scenarios that HubSpot excels in.

At least not yet. (Note: never underestimate the competition.)

Now consider the Salesforce versus HubSpot posts I mentioned at the start.

Similar to the idea above, it’s important that we (HubSpot Partners) don’t make the same mistake – and end up looking ignorant.

We need to be really clear about the scenarios we’re targeting in any ‘Salesforce versus HubSpot’ posts.

Worth noting: the odd pronouncements I’ve seen are from HubSpot Partners – I haven’t seen any from HubSpot employees. Just to be clear.

Footnote 2: Basic things are still missing in HubSpot

Consider this section a footnote to some of the earlier discussion. I don’t mean it to be a complaint about missing features – but there are some basic gaps that we need to acknowledge – especially as they relate to more sophisticated businesses.

Reporting on Gross Profit Margins

Most sales managers will want to quickly identify their most profitable deals, and then slice and dice by product, rep, industry, etc.

There’s no way to do this in HubSpot easily, so it’s off to spreadsheets they go, or at best a messy mix of calculated properties and workflows (plus code actions).

Fiscal versus Calendar Year Reporting

Whilst there’s been some improvements in the last year, there’s still some limitations on reporting with a calendar year focus (often a Sales Manager’s interest) versus fiscal year (usually a CFO’s interest) and easily comparing.

Global Payments Support

HubSpot still hasn’t rolled out Payments to Australia (and other regions) even though it was ‘announced‘ more than 2 years ago at INBOUND. This undermines a lot of confidence in HubSpot’s ability to deliver financial related product functionality globally – imagine having to admit this to a corporation who has a global presence…

Quote maturity

Plus the limitations with adding tax to line items (or even just automatically) on quotes. At the very least we should be able to automatically apply tax based on the country of quote (eg automatically apply GST to AUD quotes).

Local Data Centres

Possibly (strangely) becoming less of a concern for some corporates (depending on industry), the ability to have an Australian data centre is a priority for many large companies.

As an aside: To be fair, the product managers at HubSpot have a tough role, tasked with prioritising the features they’re going to focus on. It’s a thankless job, trying to address infinite requests with finite resources. You’ll never keep everyone happy.

Footnote 3: Determining a customer’s sophistication

We use the HubShots Framework with our clients to first benchmark their sophistication, and then prioritise the next most important areas for them to focus on and implement. The framework is essentially a maturity model that highlights where a company is currently with their use of HubSpot, and the path forward for them to increase their sophistication.